workers comp settlement taxes

However if you receive interest on overdue benefits as part of your award or settlement you may have to pay taxes on that amount. This tax-free status applies to monthly benefits checks lump sum payments settlements and payments made to the surviving spouse or dependents of someone who died in a work-related incident.

We Get Frantic Telephone Calls From Individuals Who Have Received A Notice Of Dispute From Their Employer Insurance Carrier In 2021 Mediation Workplace Injury Hearing

May 31 2019 805 PM.

. Ann Code 42-9-360 workers compensation income replacement benefits in South Carolina are tax exempt. Up to 25 cash back Generally you dont have to pay state or federal taxes on your workers compensation settlement or award. Wages and salary earned after returning to work with a partial disability and while still receiving benefits from workers comp or another program is fully taxable as income.

No workers compensation benefits are not taxable. No workers comp benefitsand workers comp settlement benefits are not taxable. The IRS manual reads.

Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax and Benefit Return. You generally dont have to pay state or federal income taxes on workers comp benefits or settlements. Exception to Tax-Exempt Status.

Your workers compensation benefits will be subtracted from your taxable income. You do not have to pay taxes on a workers compensation settlement in South Carolina. Compensation from workers comp earned from occupational injuries or illnesses is fully tax-exempt provided the insurance carrier adheres to state workers compensation laws.

This means you should never have to pay state or federal taxes on them even if you reach a settlement with the workers compensation insurance company and do not. According to the Internal Revenue Service IRS workers comp settlements under federal law do not qualify as taxable income for state or federal levels. The exemption also applies to your survivors.

While most workers do not pay taxes on their workers compensation you should be aware of the implications of this. Your workers comp settlement may still affect. In fact workers compensation settlements and payments are tax-exempt under the the Workers Compensation Act.

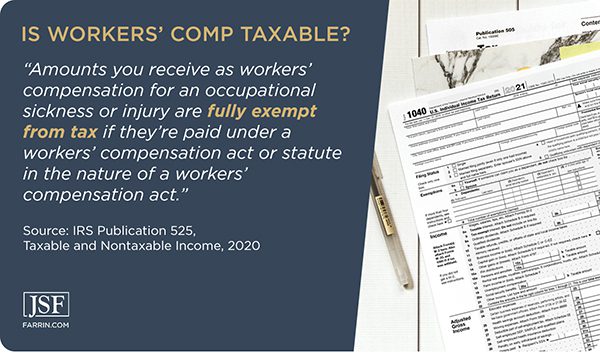

Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute in the nature of a workers compensation act. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time. Generally workers compensation settlements are non-taxable which means that an injured person can keep more money from their settlement and pay less in taxes.

According to Publication 907 Workers Compensation for an occupational sickness or injury if paid under a Workers Compensation act or similar law is exempt. However there could be liens that apply that would be deducted under certain circumstances from the employees net recovery from a workers comp settlement. Thus workers comp settlements are not taxable both at the state and federal level.

Because SSDI converts to regular social security retirement benefits when you reach full retirement age your tax status may change as well. Workers compensation benefits do not qualify as taxable income at the state or federal level. Workers compensation settlements are not taxable.

Workers compensation settlements are fully tax-exempt if paid under the Workers Compensation Act. Workers Compensation is in the same category of non taxable. For example if the injured workers medical treatment was paid in part by MassHealth which is the Massachusetts.

It doesnt matter whether youre receiving monthly payments or a lump sum settlement. Tax Implications of Settlements and Judgments. So there will be no tax consequences associated with your workers compensation benefits or workers comp settlements.

At line 22900 deduct the amount of the WCB award repaid to your employer that was included in your income on your T4 slip. This is because the payments received are considered to be compensated for lost wages and other damages which are not typically considered taxable income. The one exception to this rule applies if youre also receiving benefits through Social Security Disability Insurance SSDI.

According to this IRS publication Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code IRC Section 61 that states all income is taxable from whatever source derived unless exempted by another section of the code. If you are currently on workers compensation benefits and do not see a W-2 for the tax year while you.

The answer to your question is no. No workers compensation benefits are not taxable income. If a worker settles a workers comp case and also receives SSDISSI benefits and the settlement is an amount above 80 of their pre-injury income then their workers comp may get taxed.

As long as its part of your workers comp benefits you wont get taxed. The following payments are not taxable. But that doesnt mean youll be free from taxes if youre on workers comp.

Specifically if part of. Per IRS Publication 525 if youre on Social Security and it has been reduced by the amount of workers compensation benefits youre being paid that amount is likely taxable. IRC Section 104 provides an exclusion from taxable income with.

Usually workers compensation benefits will not affect your tax return. Lump sum settlements from workers compensation cases do not count as taxable income either.

Are Workers Compensation Settlements Taxable

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Is Workers Comp Taxable Workers Comp Taxes

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

California Workers Comp How To Take Charge When You Re Injured On The Job Brought To You By Avarsha Com Worker Take Charge Personal Injury Claims

Do I Have To Pay Taxes On My Workers Comp Benefits

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Pin On Michigan Workers Compensation Attorneys

Is Workers Compensation Taxable Klezmer Maudlin Pc

Workers Compensation And Taxes James Scott Farrin

Pin On Michigan Workers Compensation Attorneys

Is Workers Compensation Taxable In North Carolina Riddle Brantley

How Long Can A Workers Comp Claim Stay Open Canal Hr

Pin On Settlement For Workers Compensation

Average Workers Comp Settlement What Amount To Expect Kk O

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Can I Get Disability After A Workers Comp Settlement

Workers Comp Is A Safety Net For Employees Hurt On The Job It Pays Weekly Benefits To Employees Who Cannot Work Nurse Case Nurse Case Manager Case Management